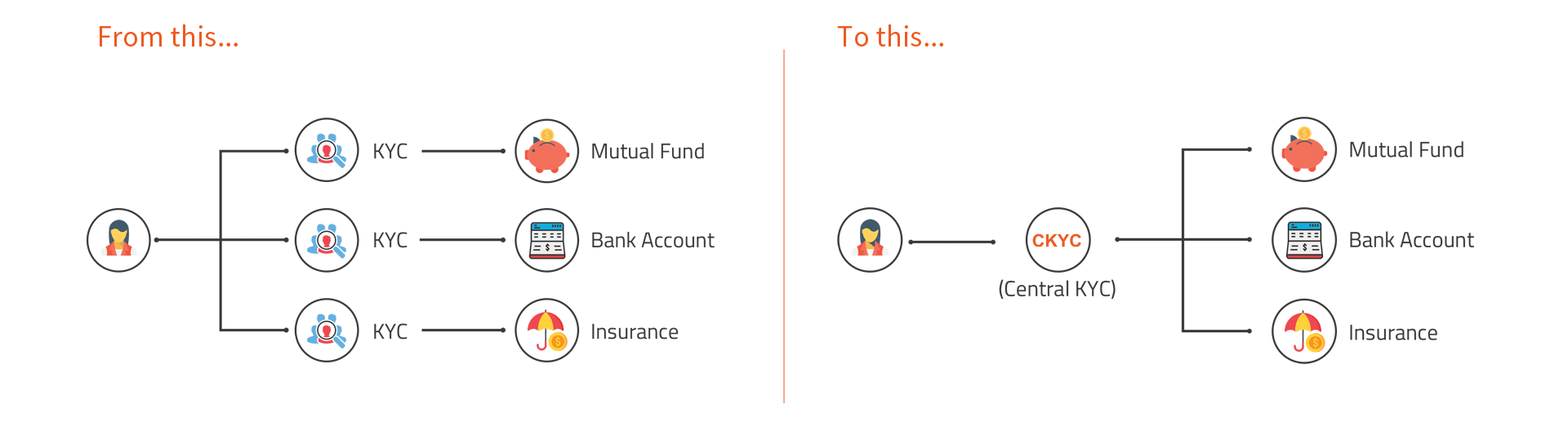

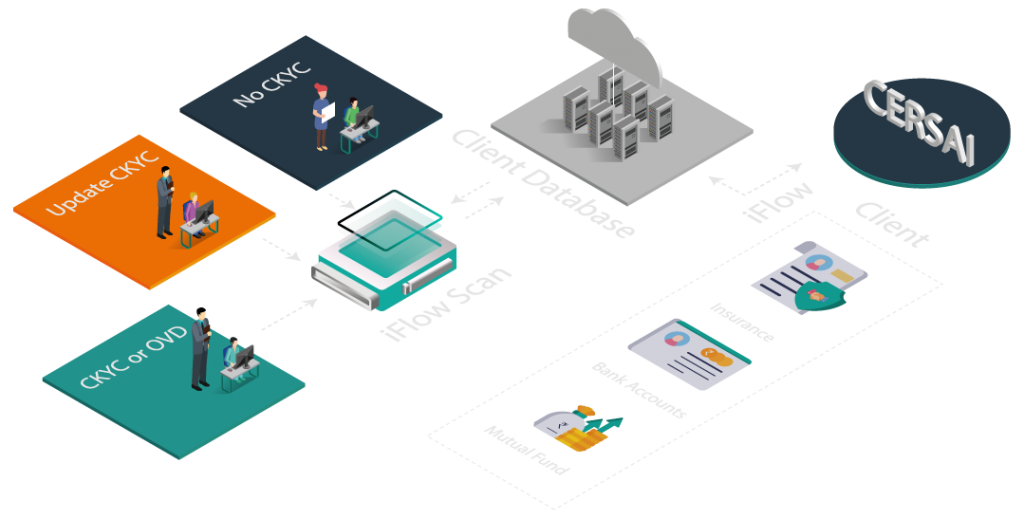

CKYC API Integration Software Solution for BFSI!

Integrate with the records of the Central KYC Registry to ensure that your customers are CERSAI CKYC compliant.

- Automated Upload/Download of KYC Records

- API-based Search & Download

- Built-in Data Management System

- Intelligent ICR/OCR Data Extraction

- Checker/Maker & De-duping Functionality

Let's Talk

Register for Free Demo