Tomorrow’s AI, Delivered Today: 100% AI-Powered Video KYC for BFSI

Fully RBI-compliant Video KYC for Banks, NBFCs, Wallets &

Neobanks with lightning-fast identity verification and deep-tech powered accuracy.

Trusted By Leading Financial Institutions

Why Traditional KYC is Failing Modern Finance

Long turnaround times, physical paperwork, compliance risks—solved with our AI-first Video KYC Platform

Our platform redefines onboarding with instant AI checks, seamless video verification, and bulletproof compliance

- Time-consuming paperwork

- Manual errors in data entry

- Non-compliant processes

- Forgery-prone documents

- Fraudulent identity misuse

AI at the Core of Every Identity Check

Long turnaround times, physical paperwork, compliance risks—solvedwith our AI-first Video KYC Platform

Match video feed with PAN/ Aadhaar image with >99% accuracy—even in low bandwidth

Ensure the customer is physically present with advanced Anti spoofing checks

Automatically extract and validate data from PAN, Aadhaar, DL, Voter ID, and more

Capture geo-location and IP address to confirm customer presence within India

Secure video calls and data with enterprise-grade encryption protocols.

Seamlessly fetch documents from verified sources.

NSDL and UIDAI-based validations included

Detect digital/physical document forgery in real-time

Reviewer-auditor flow with rule-based automation and instant decision support

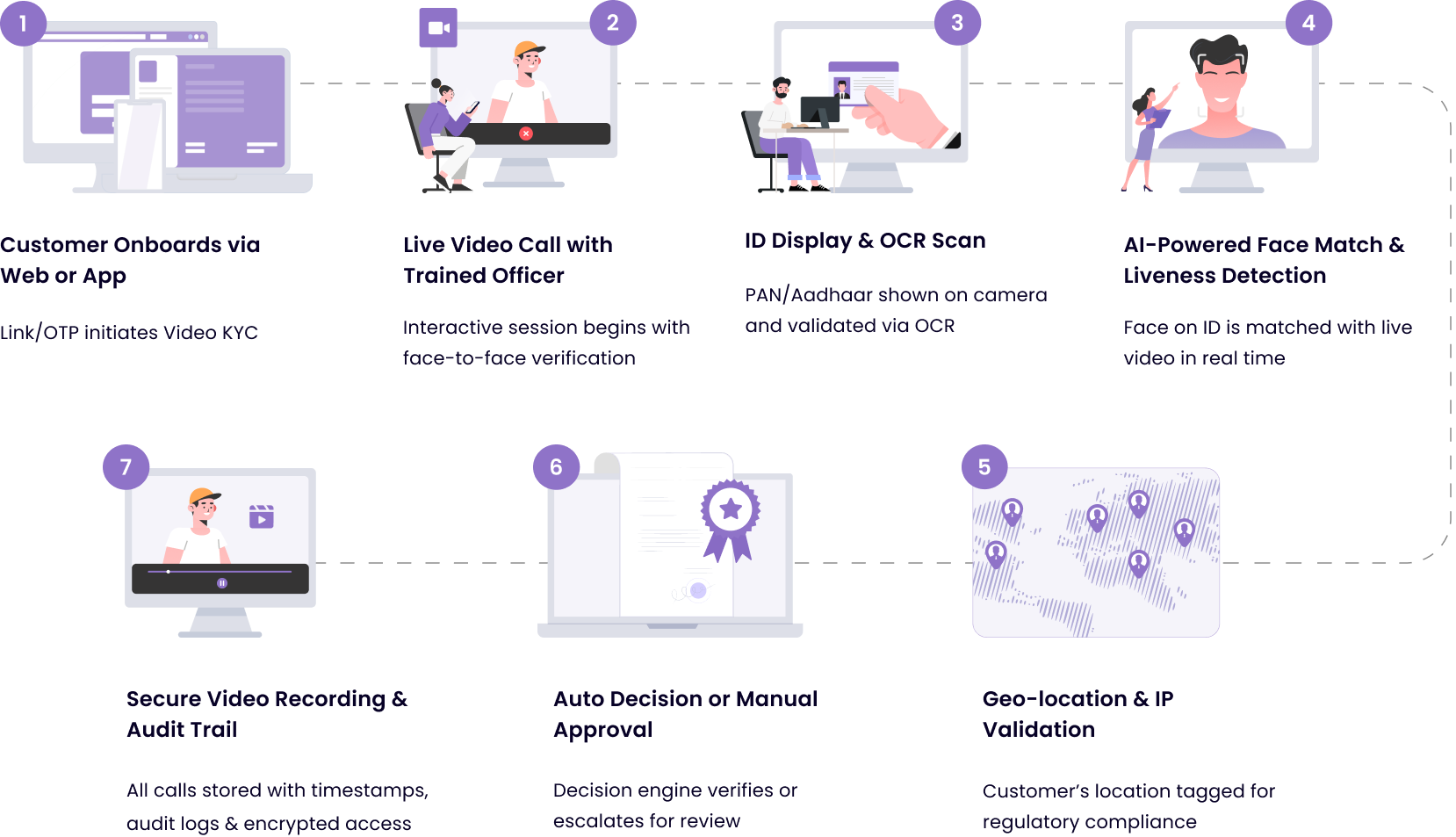

How Our RBI Compliant Video KYC Works

Streamlined. Secure. Seamless

Built for Regulated Enterprises. Trusted by BFSI Leaders

Streamlined. Secure. Seamless

Why Choose Our Video KYC Platform?

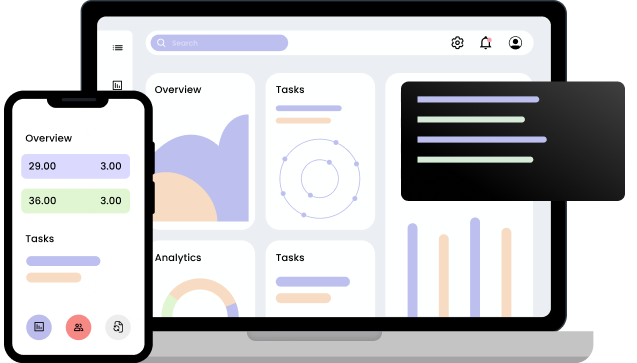

Pluggable. Scalable. Developer Friendly.

Seamlessly integrate with your systems via APIs, SDKs, and Webhooks.

Regulatory First. Security Focused.

100% alignment with India s V-CIP and KYC regulations.

- RBI-compliant V-CIP framework

- Aadhaar offline XML & DigiLocker

- Encrypted video, channel, and audit trail

- GDPR & ISO 27001 ready

- Time-stamped logs and reviewer trail

- End-to-end secured workflows

Helping Leading BFSI Brands Onboard 10X Faster

Join the fastest-growing brands simplifying KYC.

Faster TAT

Cost Reduction

Attrition rate

Regulatory Penalties

Faster TAT

Cost Reduction

Attrition rate

Regulatory Penalties

Get your free demo and discover how we help BFSI leaders onboard securely, remotely, and faster than ever.

Get your free demo and discover how we help BFSI leaders onboard securely, remotely, and faster than ever.