Aadhaar Data Vault (ADV) Platform

Secure, Compliant, and Scalable Storage of Aadhaar Numbers Fully UIDAI-Compliant

Trusted by Leading Banks, NBFCs & Insurance Providers

Why Banks Choose iStart Aadhaar Data Vault

Our ADV is designed to ensure full UIDAI compliance, maximum data protection, and

integration readiness for Aadhaar-driven processes.

UIDAI-Compliant Aadhaar Storage

Tokenization &

Vault Reference

Keys

End-to-End Encryption

With HSM (Hardware

Security Module) support

Tokenization Services

Replace Aadhaar with reference keys in app

Role-Based Access Control

Restrict sensitive

data access

Seamless API Integration

LOS, CBS, DMS, KYC

& more

Comprehensive Audit Trails

Every Aadhaar

access logged

UIDAI-Compliant Aadhaar Storage

Tokenization &

Vault Reference

Keys

Automated Data Masking

Controlled Aadhaar

number visibility

Regulatory Compliance Reports

UIDAI audit-ready

Scalable Vault Architecture

High transaction

volumes

High Availability & Disaster Recovery

Enterprise-grade

resilience

Dashboard & Monitoring

Compliance alerts,

SLA tracking

How Aadhaar Data Vault Works

A simplified, secure, and compliant flow for Aadhaar lifecycle management.

Aadhaar Capture

Aadhaar number collected from

customer onboarding systems

01

Identity Verification & KYC

Aadhaar encrypted and replaced

with Vault Reference Key

02

Secure Storage in ADV

Encrypted Aadhaar stored in ADV

03

Token Usage in Applications

Reference keys shared with LOS,

CBS, DMS, etc.

06

Controlled Access & Audit Logs

Role-based access + complete

traceability

05

Regulatory Reporting & Monitoring

UIDAI-compliant reports +

dashboard alerts

04

Aadhaar Capture

Aadhaar number collected from

customer onboarding systems

01

Identity Verification & KYC

Aadhaar encrypted and replaced

with Vault Reference Key

02

Secure Storage in ADV

Runs configurable rules (exact, fuzzy, phonetic).

03

Regulatory Reporting & Monitoring

UIDAI-compliant reports +

dashboard alerts

04

Controlled Access & Audit Logs

Role-based access + complete

traceability

05

Token Usage in Applications

Reference keys shared with LOS,

CBS, DMS, etc.

06

Engineered for UIDAI Compliance & BFSI Governance

LOS powers lending for Retail, SME, Corporate & Agri finance.

- Fully compliant with UIDAI circulars & guidelines

- Ready for RBI, IRDAI, SEBI governance requirements

- Complete audit-readiness with traceable access logs

- Helps financial institutions avoid penalties & risks

Built for BFSI Scale

Monitor vault usage, track compliance, and control access in real time.

- Handles millions of transactions per day

- High Availability & Disaster Recovery

- Future-proof architecture for digital banking needs

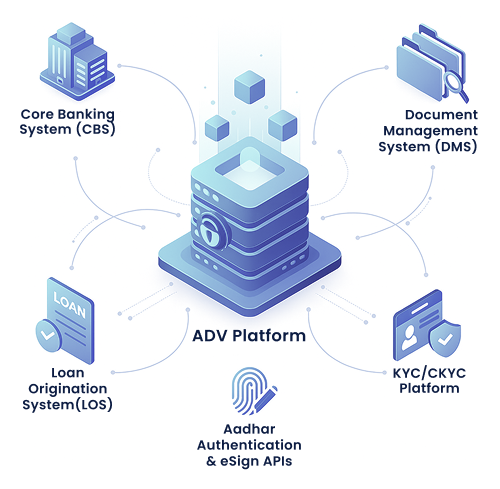

Seamless Integration with Enterprise Systems

The ADV platform is designed to work seamlessly with your existing banking infrastructure and fintech applications.

- Core Banking System (CBS)

- Document Management Systems (DMS)

- Loan Origination Systems (LOS)

- KYC / CKYC Platforms

- Aadhaar Authentication & eSign APIs

Secure Your Aadhaar Data with

us

Ensure 100% UIDAI compliance, enterprise security, and future-ready integration.

Secure Your Aadhaar Data with

us

Ensure 100% UIDAI compliance, enterprise security, and future-ready integration.