Seamlessly onboard customers with iFlow CKYC, a powerful,

API-driven, audit-ready platform trusted by BFSI institutions

for real-time CKYC uploads, downloads, and monitoring.

Built to solve every compliance pain point from document preparation to error-free CERSAI submission

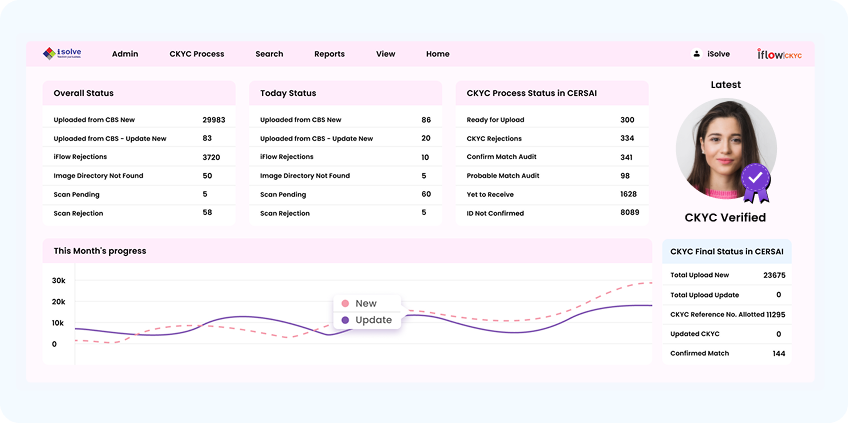

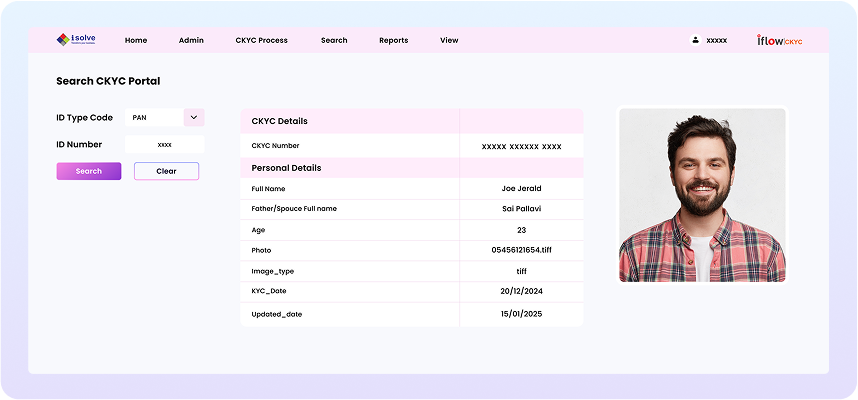

Go beyond uploads handle the full CKYC lifecycle with smart workflows, real-time error detection, and BI dashboards.

✓ Push to CERSAI with digital signature ✓ Handles batch-wise customer uploads

✓ Monitor KINs, rejections, errors, duplicate records ✓ Export reports with filters and alerts

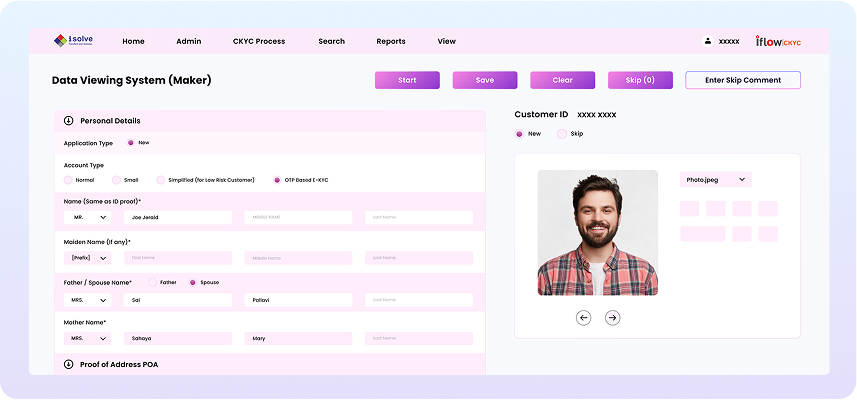

✓ Intuitive error detection & re-submission process

✓ Extracts from PDFs, images, scans using OCR ✓ Normalizes & maps data fields for CERSAI ready format

We help you stay ahead of compliance risks with end-to-end adherence to

CKYC guidelines

Plug into your core systems, CRMs, or digital onboarding stack using robust, secured APIs

Start your CKYC transformation with iFlow—trusted, automated, and 100% CERSAI-compliant.

Start your CKYC transformation with iFlow—trusted, automated, and 100% CERSAI-compliant.