Digitize & Transform Your BFSI Operations with Our Fintech APIs

Unlock automation, enhance compliance, and drive

operational excellence across banking, insurance, and

financial services.

- Instantly Verifiable

- Seamlessly Secure

- Scalable

Trusted By Leading Financial Institutions

Stay Ahead of Regulations with Seamless API Integration

Designed for BFSI enterprises to eliminate Aadhaar exposure

risks and regulatory violations.

Our API suite is designed for financial institutions looking to enhance customer experience, boost operational efficiency, and ensure compliance with industry standards.

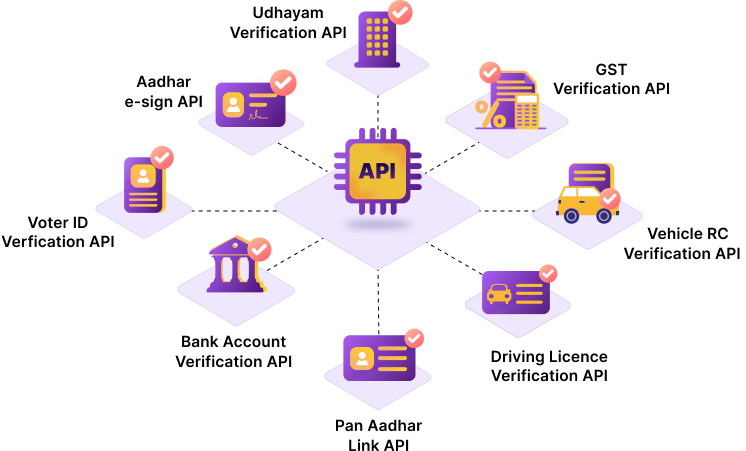

Whether it’s PAN Verification, adhaar Verification, GST Verification, Vehicle RC Verification, DL Verification, Voter ID Verification, Bank Account Verification, PAN Aadhaar Link, GSTIN by PAN, Aadhaar e-Sign, or digital onboarding. our solutions are built to transform your operations.

Key Benefits of Our Fintech APIs

All your compliance, verification, and onboarding needs now in one

seamless API suite.

Harness the power of AI to streamline KYC and customer onboarding processes. Complete verification in minutes, not days

OCR-based document verification and Identity Verification APIs to validate documents with precision and protect customer privacy.

Protect your data with end-to-end encryption, user-based access controls, and audit trails that ensure transparency and compliance.

Our APIs ensure your institution is compliant with CERSAI, RBI, UIDAI, and other regulatory frameworks, while reducing manual intervention and risk.

Access real-time data with our business intelligence dashboards, designed to give you actionable insights and streamline decision-making.

Our API solutions scale effortlessly to meet your business demands. Choose from a wide range of features and customize your workflows for ultimate flexibility

Simple integration. Powerful outcomes.

Your One-Stop Marketplace for Regulatory-Grade APIs

Plug & play APIs to digitize every stage of the customer lifecycle.

Impact of API-First Digitization

Long turnaround times, physical paperwork, compliance risks—solved with our API-first Digitization

- Reduce onboarding time by 70%

- Cut operational costs by 40%

- Improve compliance accuracy by 95%

- Eliminate duplicate KYC with advanced deduplication

- Minimize manual errors and fraud risks

Book a demo or talk to our API advisors to digitize your

operations securely, swiftly, and smartly.

Book a demo or talk to our API advisors to digitize your

operations securely, swiftly, and smartly.