Digitize & Streamline Lending — From Application to Disbursement

iStart’s Loan Origination System (LOS) Platform helps banks & NBFCs accelerate loan processing with compliance-first automation and a customer-centric experience.

Trusted by Leading Banks, NBFCs & Insurance Providers

Why Banks & Financial Institutions Choose iStart LOS

A single platform to digitize lending journeys across Retail, SME, Corporate, and Agri Lending.

Multi-Channel Loan Capture

Branch, Web, Mobile, DSA, Partner, API

Smart Identity Verification

Aadhaar eKYC, CKYC, PAN, GST, OVD integrations

Automated Credit Bureau Pulls

CIBIL, Experian, CRIF, Equifax

Configurable Credit Rules Engine

Automated policy-based decisioning

Document OCR & Auto-Extraction

Faster financial & OVD data capture

Fraud & De-Dupe Checks

Detect duplication via internal & external data

Automated Underwriting Workflows

Role-based, exception handling

Digital Agreement Execution

eSign, eStamping, Consent

Collateral & Valuation Management

For secured loans

Built for Speed, Compliance, and Scalability

Deliver loans faster while staying 100% compliant with RBI, UIDAI, and regulatory norms.

100% Compliance

UIDAI, RBI, SEBI, IRDAI,

CERSAI ready.

Scalable Platform

Expand across multiple

loan products & volumes.

Faster Turnaround

Reduce loan approval

cycles from days to

minutes.

End to End Loan Origination Journey with iStart LOS

A streamlined, compliance-first lending lifecycle

Loan Application Capture

Customer applies via Branch / Web /

Mobile / API.

01

Identity Verification & KYC

Aadhaar eKYC, CKYC, PAN, OVD, GST.

02

Credit Bureau & Risk Scoring

Automated CIBIL / Experian /

CRIF pulls.

03

Document Upload & OCR

Auto-extracts & validates financial

data.

06

Fraud & De-Dupe Checks

Prevents duplication / identity fraud.

05

Underwriting & Approvals

Configurable workflows + rule engine.

04

Agreement Execution

eSign, eStamping, Digital Consent.

07

Disbursement & Repayment Setup

CBS & payment gateway integration.

08

Analytics & Monitoring

SLA tracking, portfolio

performance dashboards.

09

Capture

Import from email, Drive, Outlook, scanners, APIs.

01

AI Extraction & OCR

Extract structured data, validate formats, auto-classify.

02

Index & Store

Smart metadata tagging, classification & encrypted storage.

03

Workflow & Approval

Send for review, e-signatures, and multi-level approvals.

04

Version Control & Audit Logs

Full change history with user stamps & document versions.

05

Access, Report, Archive

Enable search, track KPIs, and archive with retention rules.

06

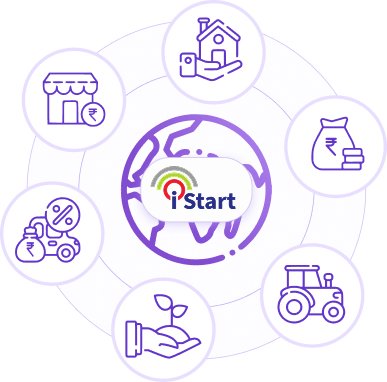

Trusted Across Loan Products & Segments

LOS powers lending for Retail, SME, Corporate & Agri finance.

- Personal Loans

- Home Loans

- Vehicle Loans

- MSME/Business Loans

- Agri Loans

- CASA-linked Loans

Real Time Insights. Better Portfolio Control.

Gain visibility into SLAs, TATs, portfolio risks, and operational efficiency with advanced dashboards.

- SLA & Turnaround Time monitoring

- Portfolio risk analysis

- Operational efficiency insights

- Business intelligence tools

Ready to Transform Your

Lending Journey?

Digitize, automate, and scale your loan origination with iStart LOS.

Ready to Transform Your

Lending Journey?

Digitize, automate, and scale your loan origination with iStart LOS.