Aadhaar is a unique 12-digit identification number that acts as proof of address and identity when accessing financial products and services. Using unmasked Aadhaar copies by banks and NBFCs is restricted, whether for storage or during the onboarding process. This not only violates RBI regulations but also poses financial and reputational risks. Masking aadhaar photos […]

Author Archives: Uday

Financial services face several challenges in managing multiple-KYC utilities, which has become a tedious process to verify customers manually. RBI introduced the Central Registry of Securitization Asset Reconstruction and Security Interest of India (CERSAI) to centralize and digitize customer KYC documents. The primary goal of CERSAI CKYC is to reduce repeated KYC verification. This blog […]

Aadhaar provides residents with offline and online identity verification across the country. An Aadhaar card can be useful when opening a bank account. In addition to KYC, it can also be used for identification and verification purposes. Aadhaar authentication is a process of verifying an individual’s identity using their Aadhaar number. Banks and financial institutions […]

Financial institutions like banks are tasked with processing millions of customer documents yearly and digitizing their records for faster storage and retrieval. Optical Character Recognition (OCR) is an emerging technology that helps extract data from pdf/images to convert paper-based documents and pdf documents to Excel, CSV, and other formats. In this blog, let us learn […]

The Indian government implemented CKYC in response to the rise of fraudulent operations in the country’s financial sector. CERSAI manages the CKYC Registry (CKYCR), which serves as a central repository for all customer personal information. CKYCR aims to ease the burden of KYC document generation and eliminate KYC compliance redundancies. According to the most recent […]

Financial organizations typically use Aadhaar as identification while providing various services, as it is a unique authentication system. In internet security, Aadhaar-based financial solutions are a growing trend. Since Aadhaar is a source of highly personal information, FIs and customers have relied on various security measures to prevent illegal access. The Aadhaar masking API solution is one […]

The FinTech sector is booming, with traditional financial institutions expanding their investments in digital and more sophisticated financial technologies to supply financial services with enhanced turnaround time and efficiency. In addition, customers expect digital-first banking services for account opening, payments, and loan processing, resulting in stringent regulatory upgrades and government involvement. Based on the report by Market […]

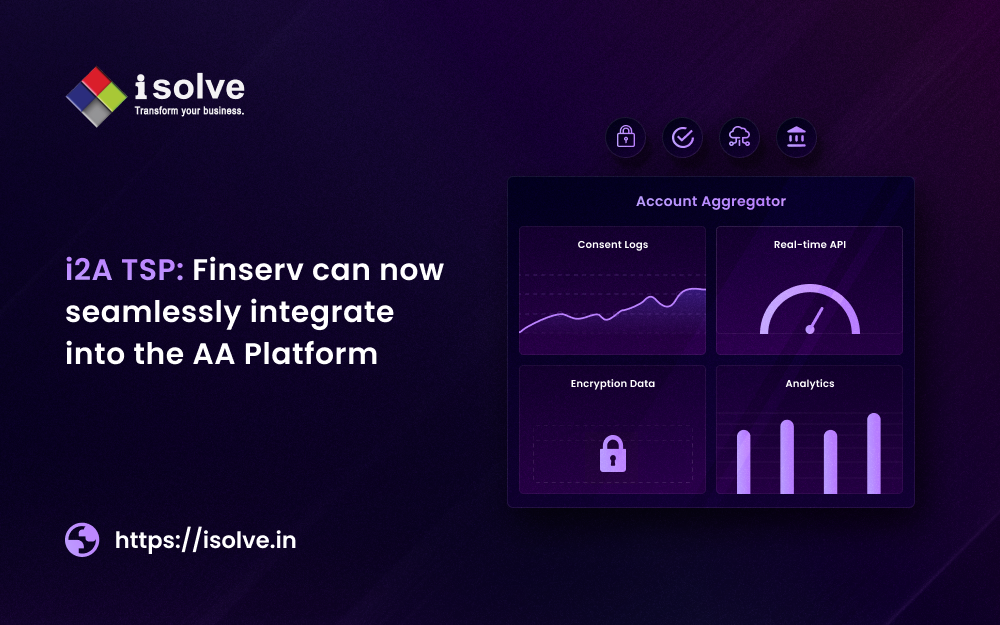

A customer’s financial information is distributed among several banks and financial service providers. This includes money in pension funds, insurance, mutual funds, and multiple bank accounts. Account Aggregators (AA) are the third party that integrates Financial Information Providers (FIPs), such as banks, mutual funds, etc., to share user data. The i2A platform functions as a Technical […]

Account Aggregator is the most discussed FinTech disruption in recent times. It is a framework proposed by RBI, and it is a consent-based digital platform that may aggregate customers’ complete financial data in silos with many entities under one platform. The AA ecosystem enables customers to share their encrypted financial data from several FIPs to FIUs via […]