Penny Drop Verification: New Tech for Instant Bank Account Authentication

Penny Drop Verification: New Tech for Instant Bank Account Authentication

Authored by: Mohammed Mansoor Reading Time: 02 min 15 sec

Authored by: Mohammed Mansoor Reading Time: 02 min 15 sec

Digital technologies have enhanced the effectiveness of customer identification. In the Identity verification process, bank account validation is a vital step as it authenticates the customer linked to that account. The previous methods for verifying a bank account were laborious and included many paperwork and bank visits.

The introduction of penny drop verification has made it easy for financial institutions to onboard customers within minutes.

This blog discusses penny drop verification, its regulations, and how it is performed.

Penny drop verification is a method used to confirm the legitimacy of a customer’s bank account. This method is referred to as “penny drop,” as it initiates a test transaction by depositing ₹1 into the customer’s account.

It is an intelligent way of completing eKYC verification in which customer information is transmitted and validated via paperless and presence-less KYC verification.

The penny drop verification allows banks and other financial service providers to expedite the onboarding and validation of their customers.

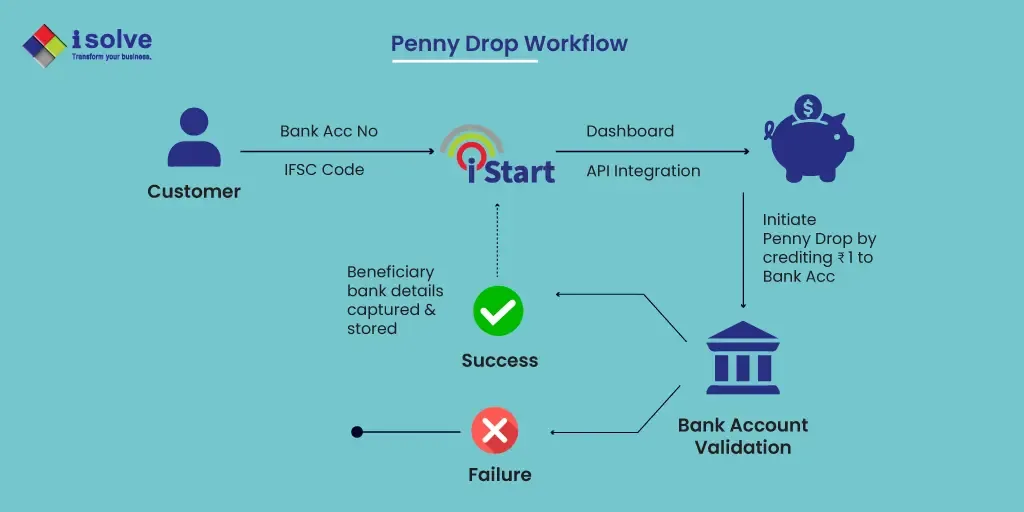

The process of penny drop verification is as follows:

The Reserve Bank of India authorized smartphone registrations for paperless and contactless delivery of unsecured loans up to ₹60,000 in December 2016.

On April 24, 2020, SEBI released standardized rules for Digital KYC. These rules let bank account verification be done using the “Penny Drop” method, in which a small amount, like 1, is taken out of the applicant’s bank account.

On July 20, 2021, PFRDA enabled the penny drop method to be used for instant bank verification. It was meant to protect the interests of pensioners and make sure that money got to the customer’s account on time.

The customer’s entitled amount should not be credited to the savings account for various reasons. Therefore, the Penny Drop validation enables banks to authenticate the pensioner’s account information before crediting the actual amount to his savings account.

The straightforward approach might be advantageous for firms because it prevents errors before substantial sums are moved.

Furthermore, penny drop plays a crucial part in eliminating fraudulent fund transfer activities in which the bank account belongs to a fraudster trying to defraud the banks. This is essential for preventing financial institutions from incurring excessive losses.

Learn how iStart integrates penny drop validation APIs with video-based remote KYC to authenticate bank account information rapidly. This procedure can prevent identity theft, securing banks’ high-volume financial transactions.

+91 93634 99313 | +91 89398 11425 | +91 93634 99328

competence_building@isolve.co.in | talentsourcing@isolve.co.in

+91 99940 56227 | +91 78258 78258

business@isolve.global

Middle East

A4 - 105A, Building No. A4

Al Hamra Industrial Zone-FZ

RAK, United Arab Emirates

M: +91 - 78240 78240

Netherlands

Strawinskylaan 3051, 1077ZX, Amsterdam,

The Netherlands.

M: +31 6495 62630

Norway

C. J. Hambros plass 2c,

0164 Oslo,

Norway.

M: +47 92 96 06 81