Online Aadhaar-based EKYC Solution for Banks & NBFCs

In conjunction with our document management solution, we can manage the complete operations relating to loans and mutual funds processing. This includes scanning, cropping, easy search and retrieval and digitization of processes.

Paperless EKYC Software Solution

iSolve EKYC solution is fully compliant with RBI regulations & KYC norms. Banks & NBFC service providers can reduce manual interventions using our digital KYC application platform by enhancing their operational efficiency.

Our Aadhaar-based EKYC integration solution is cost efficient, more adaptable and easily deployable. The user friendly temperament of our application ensures that there is maintainability, reusability, minimum manual intervention, and incremental delivery of products.

- Public Sector Banks

- Private Banks

- Foreign Banks

- Co-Operative Banks

- Regional Rural Banks

- Local Area Banks

- Factoring Companies (Private)

- Factoring Companies (Public)

- Asset Reconstruction Companies

- Financial Institutions

- Housing Finance Companies

- Security Trustee

- NBFCS - Accepting Public Deposits

- NBFCS - Not Accepting Public Deposits

- Microfinance

- e-Wallet digital banks

- Digital Payment Companies

- Digital Lending Companies

- NBFC

- Asset Management Companies

Proud Users

Digitally Authenticate Your Customers with Aadhaar EKYC in 60 Secs!

Our Digital KYC Software Solutions

CKYC Integration for Legal Entities

CERSAI CKYCR api integration application platform for SME, MSME & other corporate loan lenders.

Video KYC for Customer Identification

State of art video-kyc digital customer identity verification software solutions.

CKYC Integration for Financial Services

Fully compliant CKYC integration application software for financial reporting entities.

Aadhaar Masking API Solution

Real-time computer vision and OCR to identify and mask Aadhaar numbers to protect consumer privacy and comply with UIDAI.

Frequently Asked Questions

UIDAI (Unique Identification Authority of India) provides paperless eKYC API integration to electronically collect demographic details of Aadhaar holders for proof of identity (POI) and address (POA) verification. It is a secured and compliant KYC verification methodology used by financial service providers to instantly authenticate customer KYC.

UIDAI approved paperless offline Aadhaar eKYC application interface (API ) helps financial service providers to instantly collect digitally signed XML KYC document of customers. It contains their demographic details like name, address, gender, date of birth, mobile number, and email address to verify their proof of identity (POI) and address (POA).

Below are two types of Aadhaar eKYC approved by RBI.

1. Biometric verification: Customers have to complete their KYC verification by providing a 12 digit Aadhaar number along with biometric authentication such as fingerprint and retina scan.

2. OTP verification: The customer has to provide OTP sent by UIDAI to their registered Aadhaar number to complete the verification process.

Below are the two factors to consider while selecting eKYC service provider or vendor.

1. Only UIDAI approved eKYC licensed service providers can access the Aadhaar demographic details like name, address, gender, date of birth, mobile number, and email address to verify the customers.

In-house secured and compliant Aadhaar vault infrastructure to protect the customer's data.

Here are the three offline eKYC verification methods used by service providers.

1. Paperless offline eKYC: It allows service providers to electronically download digitally signed XML documents of customers from the UIDAI portal through API integration.

2. mAadhaar app: It allows service providers to extract Aadhaar demographic details through the mobile-based application.

3. QR Code Scan: Service providers have to scan the QR code given in the Aadhaar card using a QR scanning application to extract demographic details of the customers.

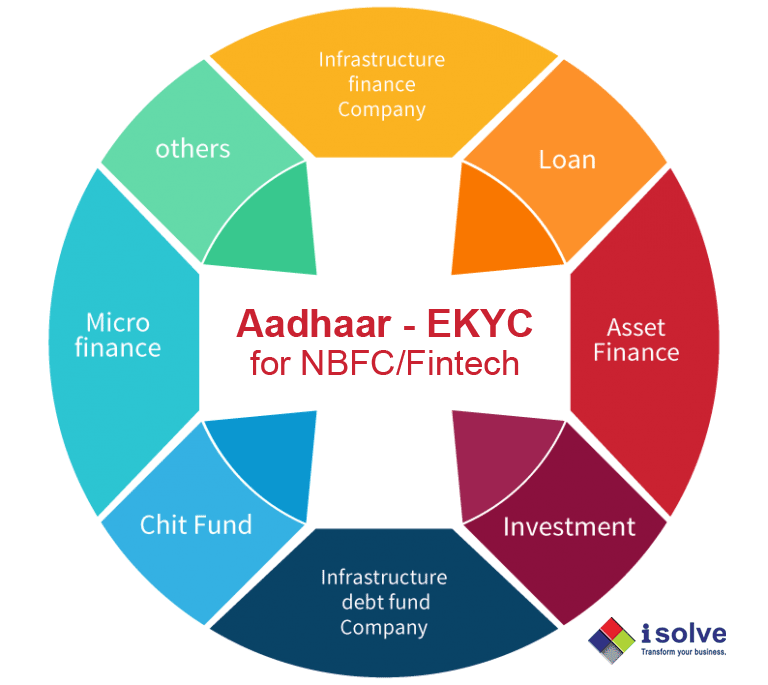

Recently, RBI has approved Banking, Non-banking (NBFC), microfinance (MFI) & payment system (FINTECH) service providers to utilize Aadhaar eKYC integration solution from licensed KYC User Agencies (KUA) to verify and authenticate their customers.

Contact Us

For HR enquiries

+91 93634 99313 | +91 89398 11425 | +91 93634 99328

competence_building@isolve.co.in | talentsourcing@isolve.co.in

For Sales enquiries

+91 99940 56227 | +91 78258 78258

business@isolve.global

Quick Links

Our Global Locations

Middle East

A4 - 105A, Building No. A4

Al Hamra Industrial Zone-FZ

RAK, United Arab Emirates

M: +971 - 5238 66435

Netherlands

Strawinskylaan 3051, 1077ZX, Amsterdam,

The Netherlands.

M: +31 6495 62630

Norway

C. J. Hambros plass 2c,

0164 Oslo,

Norway.

M: +47 92 96 06 81