4 Ultimate Benefits of iStart Video KYC for Financial Inclusion in 2022!

4 Ultimate Benefits of iStart Video KYC for Financial Inclusion in 2022!

Authored by: Mohammed Mansoor Reading Time: 2 mins 12 secs

Authored by: Mohammed Mansoor Reading Time: 2 mins 12 secs

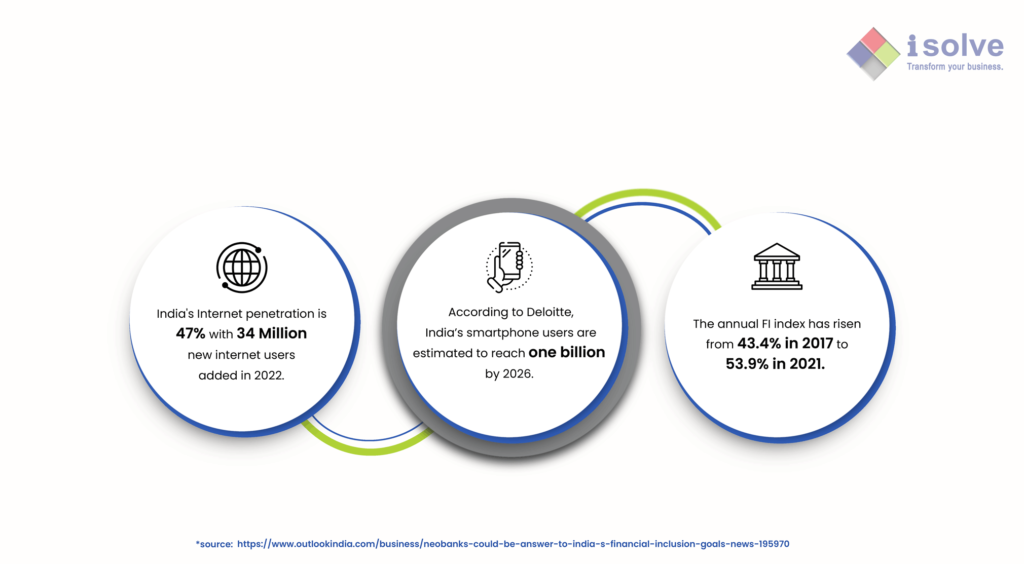

Financial Inclusion is a process by which individuals and businesses can access financial products, services, and technologies that equitably meet their needs in a simple, secure, and timely manner.

It is critical to the country’s economic success and ensures the low-cost and transparent distribution of financial products and services to individuals from all walks of society.

This blog explains how iStart Video KYC process can accelerate the pace of financial Inclusion through remote onboarding and KYC verification.

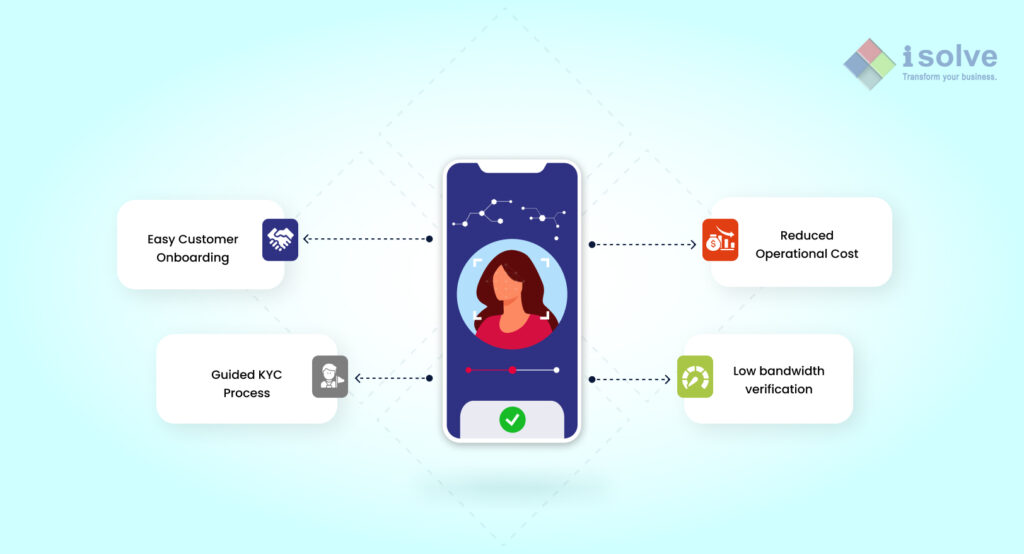

Financial services can use video KYC as a cost-effective method of customer verification. They may quickly expand their products and services to a wide range of customers nationwide with lower KYC costs and adequate KYC verification.

iStart video KYC is purpose-built for financial services to provide quick and easy access to their products and services for unbanked and underbanked areas in India. With a low bandwidth mode and a guided step-by-step approach, the platform ensures that financial assistance may reach even the most remote rural locations of India, bridging the gap between individuals and financial services. For further information visit, https://isolve.in/video-kyc-onboarding-software-solutions/

Video KYC is an RBI-approved process of verifying and validating a customer through a virtual, audio-visual interaction to fulfil KYC/AML guidelines. The process is equipped with advanced facial recognition, liveness detection, and geolocation features to ensure the authenticity of the customer while onboarding remotely from the comfort of their homes.

It is performed by KYC agents who guide the customers during the video call to finish their identity verification procedure efficiently. Our guidance makes it simple for the customers to understand the process and prepare the appropriate official verification documents. Furthermore, video KYC verification has encouraged more individuals to apply for loans than physical KYC verification due to its streamlined approach.

The Reserve Bank of India (RBI) emphasizes that improving the banking accessibility of individuals can offer financial services a huge commercial opportunity. For Banks and NBFCs, embracing future technologies and products is critical in pursuing financial inclusion.

iStart’s Video KYC Software Solution could be the ideal solution for improving customer and financial inclusion. Our Digital KYC and AML Onboarding Software Solutions help financial services have their operations secure and their customers happy. It enables a more efficient and safe verification process compatible with modern onboarding practices.

+91 93634 99313 | +91 89398 11425 | +91 93634 99328

competence_building@isolve.co.in | talentsourcing@isolve.co.in

+91 99940 56227 | +91 78258 78258

business@isolve.global

Middle East

A4 - 105A, Building No. A4

Al Hamra Industrial Zone-FZ

RAK, United Arab Emirates

M: +91 - 78240 78240

Netherlands

Strawinskylaan 3051, 1077ZX, Amsterdam,

The Netherlands.

M: +31 6495 62630

Norway

C. J. Hambros plass 2c,

0164 Oslo,

Norway.

M: +47 92 96 06 81