A Quick 5-step Remote Client Onboarding Process for Portfolio & Wealth Managers

A Quick 5-step Remote Client Onboarding Process for Portfolio & Wealth Managers

Authored by: Mohammed Mansoor Reading Time: 02 min 20 sec

Authored by: Mohammed Mansoor Reading Time: 02 min 20 sec

In case you missed our previous blogs about onboarding process, please click, https://isolve.in/blog/

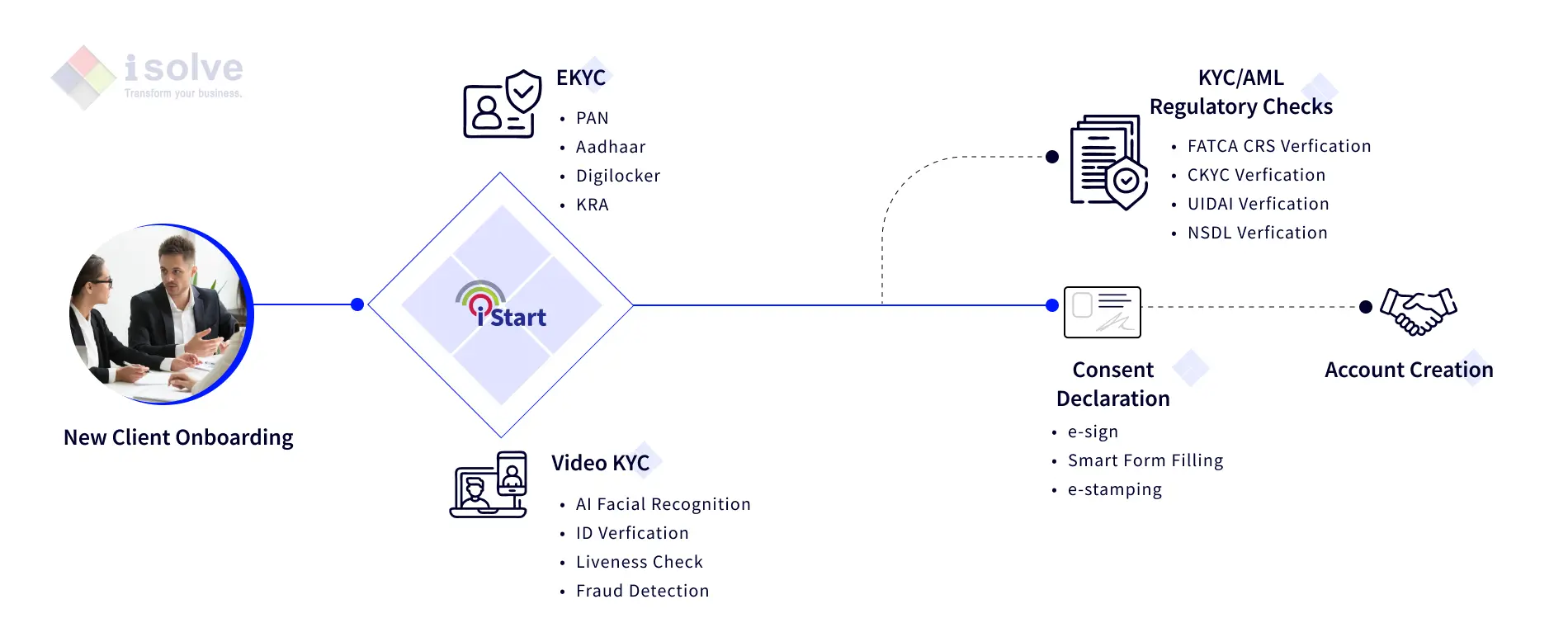

With the eKYC process, clients can submit their PAN and Aadhaar details online. The uploaded identity documents are promptly authenticated, facilitated by digital API integrations with Digilocker and KRA (KYC Registration Agency).

iStart client onboarding platform utilizes intelligent process automation, with ML & ICR/OCR functionalities to collect, extract & validate client information for KYC verification.

Video KYC enables clients to onboard remotely via a secure audio-visual interaction performed by the portfolio firms. Modern AI technologies, such as facial recognition, liveness detection, and fraud detection, enable client identity verification in real-time.

This step allows clients to virtually verify their identity in the comfort of their home or workplace.

Consent declaration using e-Signature, e-stamping, and smart forms enable portfolio managers to complete documentation and get quick authorization from investors.

This eliminates the paper-intensive manual approach and facilitates the effective use of digital data.

The platform offers online portfolio account approvals for clients to instantly access financial services and products. The complete process of onboarding a portfolio client takes approximately 30 to 60 minutes or even faster.

iStart client onboarding software is a digital solution that helps portfolio managers streamline the account opening process and perform KYC checks for their clients.

1. Client onboarding should be quick and easy to boost client happiness, revenue, and process efficiency.

2. The standard procedure for creating a new account is time-consuming and carries a high risk of getting flagged as a NIGO.

3. SEBI requires portfolio firms to directly onboard their clients rather than using intermediaries, such as advisors or clearing firms.

4. Digital client onboarding speeds up the process with KYC, AML, & regulatory integrations, facial recognition, and OCR technology.

5. For faster, safer, and more compliant onboarding solution, contact us to schedule a free demo.

+91 93634 99313 | +91 89398 11425 | +91 93634 99328

competence_building@isolve.co.in | talentsourcing@isolve.co.in

+91 99940 56227 | +91 78258 78258

business@isolve.global

Middle East

A4 - 105A, Building No. A4

Al Hamra Industrial Zone-FZ

RAK, United Arab Emirates

M: +971 - 5238 66435

Netherlands

Strawinskylaan 3051, 1077ZX, Amsterdam,

The Netherlands.

M: +31 6495 62630

Norway

C. J. Hambros plass 2c,

0164 Oslo,

Norway.

M: +47 92 96 06 81