Investment Managers: Build the Best Client-advisor Relationship with Onboarding Automation

Investment Managers: Build the Best Client-advisor Relationship with Onboarding Automation

Authored by: Mohammed Mansoor Reading Time: 02 min 20 sec

Authored by: Mohammed Mansoor Reading Time: 02 min 20 sec

Our previous blog covered the impacts of isolated onboarding process on client relationships for portfolio and wealth managers. This blog talks about the importance of automating the client onboarding process to make investor portfolio account creation simple and easy.

The digitization of client onboarding and life cycle management has become talk of the town as more investors have turned digital-savvy. Both the buy-side and the sell-side now focus on enhancing the onboarding process to provide organizations with a competitive edge by fostering strong client relationships.

True digital transformation is now possible with a new wave of onboarding technologies. iStart can speed up and simplify client account opening processes with shortened turnaround times and lesser manual human errors.

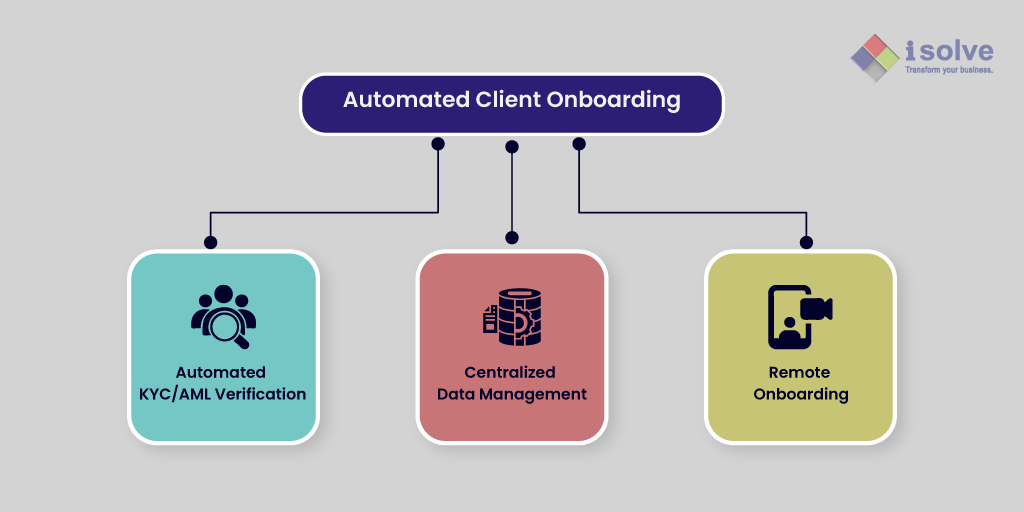

The distributed compliance model of the the platform enables real-time KYC/AML verification and automates due diligence to ensure 100% fully compliant accounts. This model leads to centralized compliance and data distribution within the organization.

Relationship managers may finish the early responsibilities of due diligence using this model. The compliance team receives this information in real time. It helps them streamline decision-making and fasten the process. This makes onboarding easier and more centralized, increasing transparency and enhancing the process experience.

Client data flow is critical for portfolio and wealth management services to ensure a seamless onboarding experience. Relationship managers need a comprehensive view of the onboarding process to spot any bottlenecks in various organizational channels.

The platform’s video KYC enables investment managers to onboard their clients remotely with 100% compliance through facial recognition technology. It enables them to adopt a digital-first remote engagement model that reduces the need for direct visits.

The platform digitally and securely manages the onboarding journeys. It allows them to go through all internal approval procedures for onboarding activities remotely. (From account origination, KYC, compliance, and legal to account opening).

The future lies in digital acquisition and servicing, which investment managers need to adopt for seamless and lasting investor-advisor relationships.

iStart helps portfolio and wealth management services to begin their investment journeys online through mobile and remote onboarding applications offering an enhanced onboarding experience.

This digitization offers client-facing advisors the ability to manage and oversee each instance without any hassle under strict compliance control.

+91 93634 99313 | +91 89398 11425 | +91 93634 99328

competence_building@isolve.co.in | talentsourcing@isolve.co.in

+91 99940 56227 | +91 78258 78258

business@isolve.global

Middle East

A4 - 105A, Building No. A4

Al Hamra Industrial Zone-FZ

RAK, United Arab Emirates

M: +971 - 5238 66435

Netherlands

Strawinskylaan 3051, 1077ZX, Amsterdam,

The Netherlands.

M: +31 6495 62630

Norway

C. J. Hambros plass 2c,

0164 Oslo,

Norway.

M: +47 92 96 06 81