CKYC API Integration for Regulated Entities!

iSolve CKYC API Integration enables Individuals & Regulates Entities (REs) such as Banks, Insurance & Fintech services to manage their customer KYC records with CERSAI Central KYC Registry.

Our CKYC API integration eliminates the manual process of customer records maintenance with the central KYC registry (CKYCR) increasing your business productivity. It is fully compliant with RBI guidelines and platform-specific rules to efficiently onboard your customers.

Our CKYC API Integration Features

Automated bulk KYC upload/download

- Scheduling bulk upload/download activities using Straight Through Processing method- (STP) onto the CERSAI CKYC application

- Interface with an FI’s KYC data repository and convert the proprietary data into the CERSAI’s bulk upload format

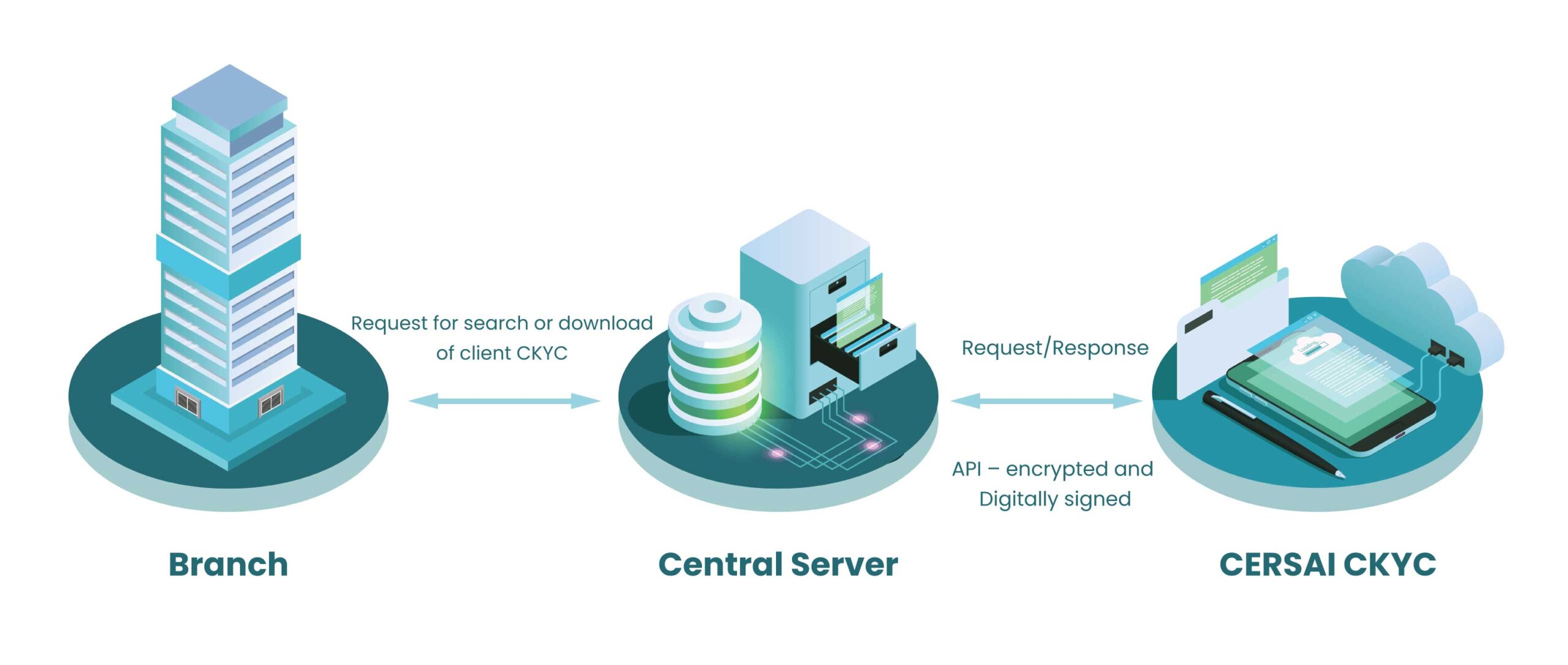

CKYCR API Integration

- Fully automated system compliant with central KYC registry guidelines & norms

- Seamless API integration of FIs core data system to CERSAI CKYCR for intelligent search & download of customer info

API-based search & download solution

- White-listing of Internet protocol (IP) address for both an FI and the CERSAI

- Search look-up through API to check whether the required CKYC is present in CERSAI database or not

- Request for search/download of client KYC from an FI

- Auto response generation of customer details for the request initiated by FI

Update of KYC record

- Built-In Data Management System (DMS) for archival & retrieval of customer history data

- Automated SFTP (Secure File Transfer Protocol) customer data capture

- Intelligent process to identify multiple official valid documents (OVD’s) of a single customer on parameters like Date of Birth, PAN Number, Aadhaar Card, Driving License, Voter Card, etc

Checker/Maker Functionality

- Fully automated Checker/Maker functionality

- Identification of De-duping of the customer at the time of on-boarding

User Interface

- API / Cloud / Web services which can be interfaced with multiple back offices simultaneously

Analytics & Insights

- Region Wise/Branch wise analytics of pending, uploading, and even uploaded CKYCR data

- Real-time MIS Dashboard, duly displaying the details of accounts opened, uploaded, approved, rejected daily

- Comprehensive insights with probable match, New Customer, Notification Management and Replicate Modification etc

Enhanced Customer Due Diligence for Regulated Entities!

Automized CKYC Solutions for Better Business Impact!

Smart Document Management System (DMS) for Storing & Retrieving customer data

Better control of MIS reports & user management

Banks & FIs can stay focused on their core business of serving their customers

Unify KYC data across all financial regulators (RBI, SEBI, IRDA and PFRDA) for Investors

Inter-usability of KYC data enabling one time KYC submission system

Compliant CKYC API Integration for Regulated Entities!

Our Digital KYC Solutions

CKYC Integration for Legal Entities (LEs)

Web/Cloud based CERSAI CKYCR api integration application platform for SME, MSME & other corporate loan lenders.

Video KYC for Digital Customer Onboarding

Stay ahead of the curve with our state of art video-kyc digital customer onboarding application solutions.

Aadhaar e-KYC Integration for NBFC’s

Simplify your investors & customers account opening with our intelligent Aadhaar based e-KYC api integration.

CKYC Integration for Fintechs

Hassle-free CERSAI CKYCR API integration to bulk upload/download verified KYC customer records.

Proud Users

Frequently Asked Questions

Central KYC records registry (CKYCR) has been created to store and manage customer KYC documents centrally to enable the one-time KYC submission system for enhanced customer financial relationships.

Every financial Reporting (REs) and Legal Entity (LEs) is required to file the electronic copy of the client’s e-KYC records with the CKYCR, within 3-10 days of customer onboarding.

Contact Us

For HR enquiries

+91 93634 99313 | +91 89398 11425 | +91 93634 99328

competence_building@isolve.co.in | talentsourcing@isolve.co.in

For Sales enquiries

+91 99940 56227 | +91 78258 78258

business@isolve.global

Quick Links

Our Global Locations

Middle East

A4 - 105A, Building No. A4

Al Hamra Industrial Zone-FZ

RAK, United Arab Emirates

M: +971 - 5238 66435

Netherlands

Strawinskylaan 3051, 1077ZX, Amsterdam,

The Netherlands.

M: +31 6495 62630

Norway

C. J. Hambros plass 2c,

0164 Oslo,

Norway.

M: +47 92 96 06 81